What is unimproved value?

Unimproved value (UV) is the value of the land only. For land within the metropolitan area and within regional townsites the UV includes merged improvements such as drainage, levelling, and filling.

The UV is provided to:

- RevenueWA to determine land tax (for properties that are not the owner’s primary residence)

- Local governments to determine rates on some properties of a rural or rural-residential nature

Each rating authority sets their own rate in the dollar to be charged. The rate in the dollar is multiplied by the UV to calculate the total of rates or taxes payable (local governments may also add levies e.g. rubbish collection). You should find details of the UV and rate in the dollar, used to calculate your rates or taxes, in the bill notices received from the respective rating authority.

If you have a query on your land tax, contact RevenueWA or for queries on the rate in the dollar on your rates notice, contact the respective local government.

How and when is the UV determined?

Step 1: Date of Valuation (DoV)

All land in Western Australia is assessed annually using the DoV of 1 August from the previous year. This is to ensure that a fair and equitable assessment is completed.

The UV is not an assessment at the current market, but an assessment reflective of a retrospective vacant land sales market as at the DoV.

Step 2: UV is determined

Vacant land sales evidence at the DoV is collected and analysed by our valuers to establish property market levels.

Individual property attributes and constraints are then considered to determine the UV for each property. These may include:

- location

- land area, lot configuration and topography

- zoning and development potential

- views or proximity to busy roads.

The UV reflects what the land would be expected to sell for in its current condition. For land within the metropolitan area and regional townsites, UV would also include any work undertaken, or materials used, to improve the physical nature of the land to prepare it for development. Read more here.

Find out more about the calculation of other land categories below:

- Land outside the metropolitan area or regional townsites

- Rural land

- Land associated with units in a strata plan

Step 3: UV is applied to land tax and some rates

UVs are provided to RevenueWA to calculate land tax and to local governments to calculate rates on some properties of a rural or rural-residential nature.

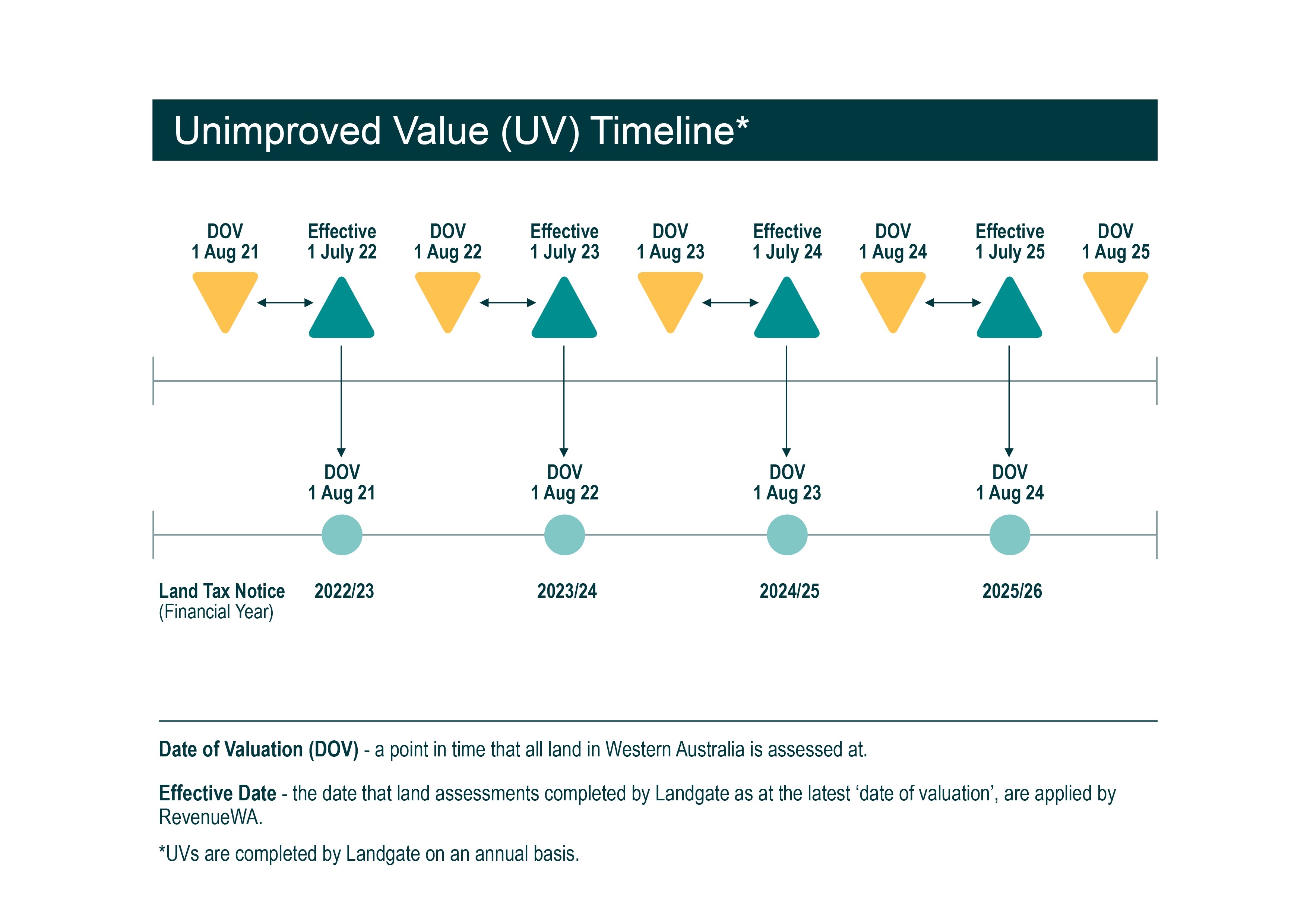

You can see how the UV is applied to your land tax notice on an annual basis in the diagram below.

For any further queries on the UV, please contact our Customer Service team.

Frequently asked questions

UV reflects what the land would be expected to sell for in its current condition. For land within the metropolitan area and regional townsites, the UV includes any work undertaken, or materials used, to improve the physical nature of the land to prepare it for development.

What is considered?

- Clearing vegetation on the land.

- Picking up and removing stones.

- Works to manage or remedy contamination.

- Restoring, rehabilitating, or improving the land’s surface by filling, grading, or levelling.

- Reclaiming land by draining or filling, including retaining walls, and other works for the reclamation.

- Underground drainage.

- Any other works done to the land that are necessary to improve or prepare it for development.

What is not considered?

- Structural improvements on the land such as houses, buildings, sheds, fencing, dams, and landscaping.

- Minor works such as providing soil for gardens, retaining walls for landscaping purposes, and pruning or removal of trees for beautification purposes.

- Excavations for pools, spas, fishponds, underground car parks, and the footings/ foundations of a structure.

- Internal roads and driveways.

- Irrigation or conservation works.

- Services such as water and sewerage pipes and associated excavations.

The land associated with units in a strata plan is valued as a single UV. The UV is provided to the RevenueWA who will apportion rates and land taxes (if applicable) for each unit owner, in accordance with the unit entitlement on the registered strata plan.

Land outside the metropolitan area or regional townsites (in general, rural land) is valued in its original natural state having regard for sales evidence as at the date of valuation. The unimproved value (UV) may consider degradation of the land and any services or amenities that may add value.

- The first assumes the property is to be valued in its original ‘bush’ state without improvements.

- The second generally applies to larger cropping and grazing properties, which are valued on the basis of 50% of their cleared overall value inclusive of clearing, fencing, pastures and waters, but excluding buildings. The 50% representing the current prescribed percentage set by Valuation of Land Amendment Regulations 2009.

There are certain exceptions where the UV is based on a statutory formula, such as a fixed rate per hectare or a multiple of the annual rent. These exceptions include mining tenements, leases of Crown Land under the Land Administration Act 1997 for the purpose of grazing, leases under agreement acts, and land held under the Conservation and Land Management Act 1984.